Ayushman Bharat Expands to Include Seniors, Addressing Unique Healthcare Challenges

By Arunima Rajan

Seniors face unique healthcare challenges such as chronic conditions, reduced mortality and mental health issues, which Ayushman Bharat can address through specialised geriatric wards and routine checkups.

*Vijayalakshmi P, a small-town general physician, gave little thought to health insurance throughout her 50s and 60s. Her late husband’s pensioner's family coverage was a safety net. In her 70s, the need for dedicated coverage became clear. “I’m glad the government has now included those over 70 under the Ayushman Bharat scheme,” she says. “It lets me be independent of my children’s insurance policies.” Though pleased with the inclusion, she cautiously adds, “Of course, the question remains— which hospitals are covered under the scheme?”

The recent expansion of Ayushman Bharat to include senior citizens over the age of 70 marks a significant step towards enhancing healthcare accessibility for the elderly. It aims to alleviate financial strain on families and ensure that older adults receive the medical attention.

As per the “India Ageing Report 2023,” released by the United Nations Population Fund (UNFPA) with the International Institute for Population Sciences, India has a rapidly ageing population. By 2050, one in every five people in the country will be over the age of 60, highlighting the need to address the challenges of an ageing society.

Societal Attitudes Towards Elderly

Pavan Choudary, Chairman, Medical Technology Association of India (MTaI) says that the utility of elders has diminished, as the repository of knowledge they carried is only a google-click away and industrialization has mobilized the young away from family professions, towards nuclear families. Increasing healthcare and caregiving costs can make elders seem like an expensive burden. “Many caregivers fall in the ‘sandwich generation’, with parents to care for on one side and their own children to care for on the other,” he says.

“MTaI has long advocated for this inclusion, and I am pleased to see it materialize. However, this change will present challenges, such as capacity issues. Hopefully, with an allocation of 500,000 INR for hospital expenses, it will be uncommon for patients not to secure a bed. This may prompt capacity expansion within providers.”

“Research shows that when insurance covers healthcare costs, the hospital sector expands. This growth benefits hospitals, businesses, and MedTech. Since hospitals comprise 70% of the healthcare sector, their expansion positively impacts MedTech as well. With the rise of homecare, there's a need for simplified and miniaturized MedTech,” he adds.

“Currently, we face a stark imbalance: 20% of the global disease burden with only 6% of the beds. Homecare can address this. Home ICU care costs a third of hospital ICU care, and general homecare is just a tenth of hospital cost. Patients recover better in a familiar environment. While there are safety risks, proper training can mitigate them. Health insurance should cover homecare for the elderly.”

Increase in Demand for Geriatric Care

Santosh Abraham, CEO of Elder Aid Wellness, an eldercare startup, describes the initiative aa a significant step forward in ensuring healthcare for one of the most vulnerable age groups in India. “With seniors often requiring frequent medical attention, this reduces costs and provides access to quality healthcare. This move might increase demand for geriatric care, promoting the development of more senior-specific services and infrastructure. This expansion will help ensure that even economically disadvantaged elderly people can access care. It can improve life expectancy and the quality of life for millions,” adds Abraham.

Challenges in Eldercare

Abraham notes, seniors above 70 face several unique healthcare challenges such as chronic conditions (hypertension, diabetes, arthritis), reduced mobility, dementia, and a heightened risk of falls and fractures. “They often face mental health issues such as loneliness and depression, compounded by limited access to mental health services. Ensuring that healthcare providers are equipped to handle these specific needs is essential. Specialised geriatric wards and routine checkups are necessary,” explains Abraham.

He adds that while this is a positive step, there are still gaps. “Many hospitals may not have specialised geriatric wards or trained staff who understand the unique needs of seniors. We need more geriatric training programmes for healthcare workers, more senior-friendly hospitals, and to include preventive and home-based care under the scheme. Strengthening follow-up services and integrating telemedicine will enhance access for seniors with mobility issues. Focus should be placed on mental health support and wellness programmes,” he concludes.

Universal Health Coverage

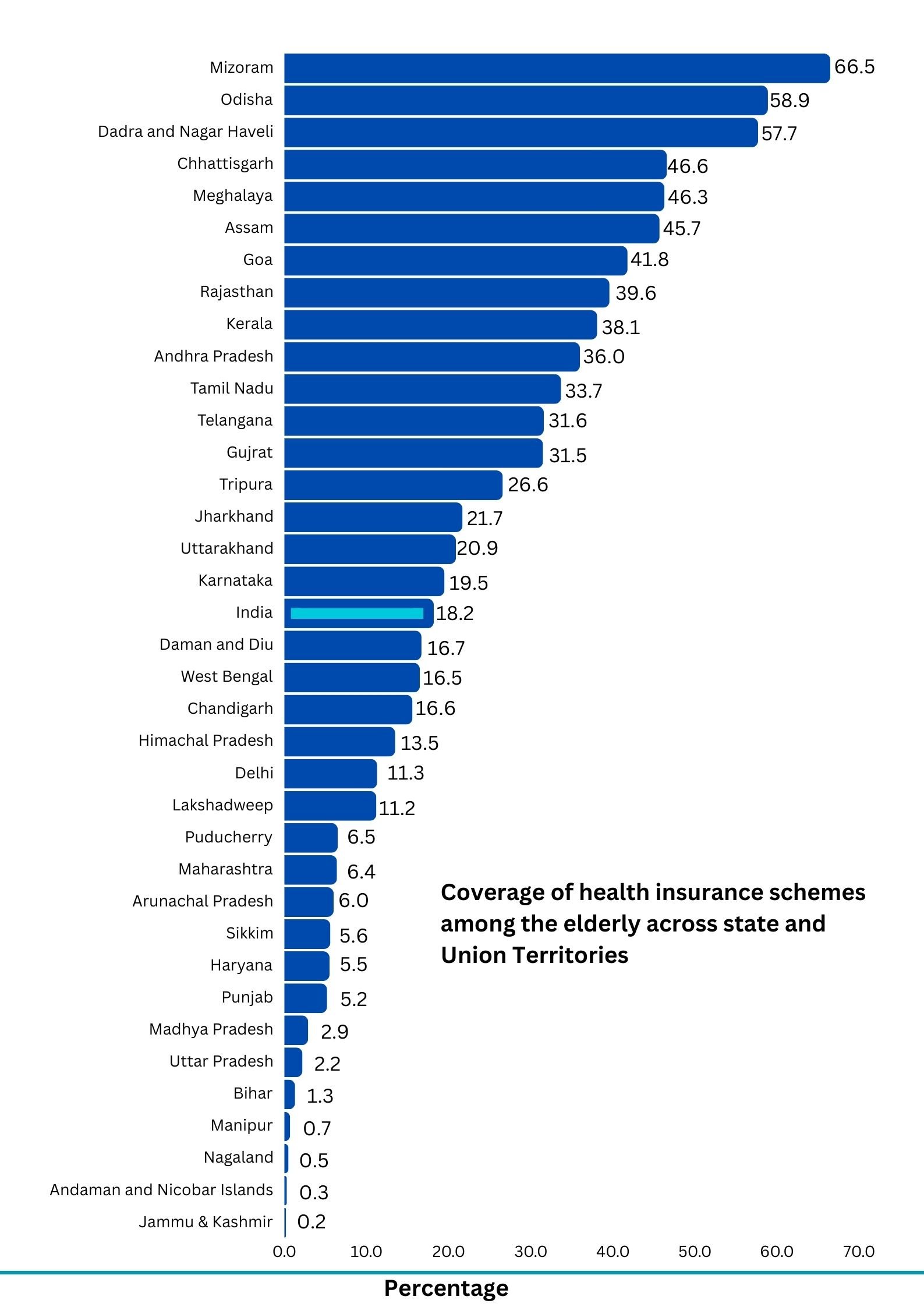

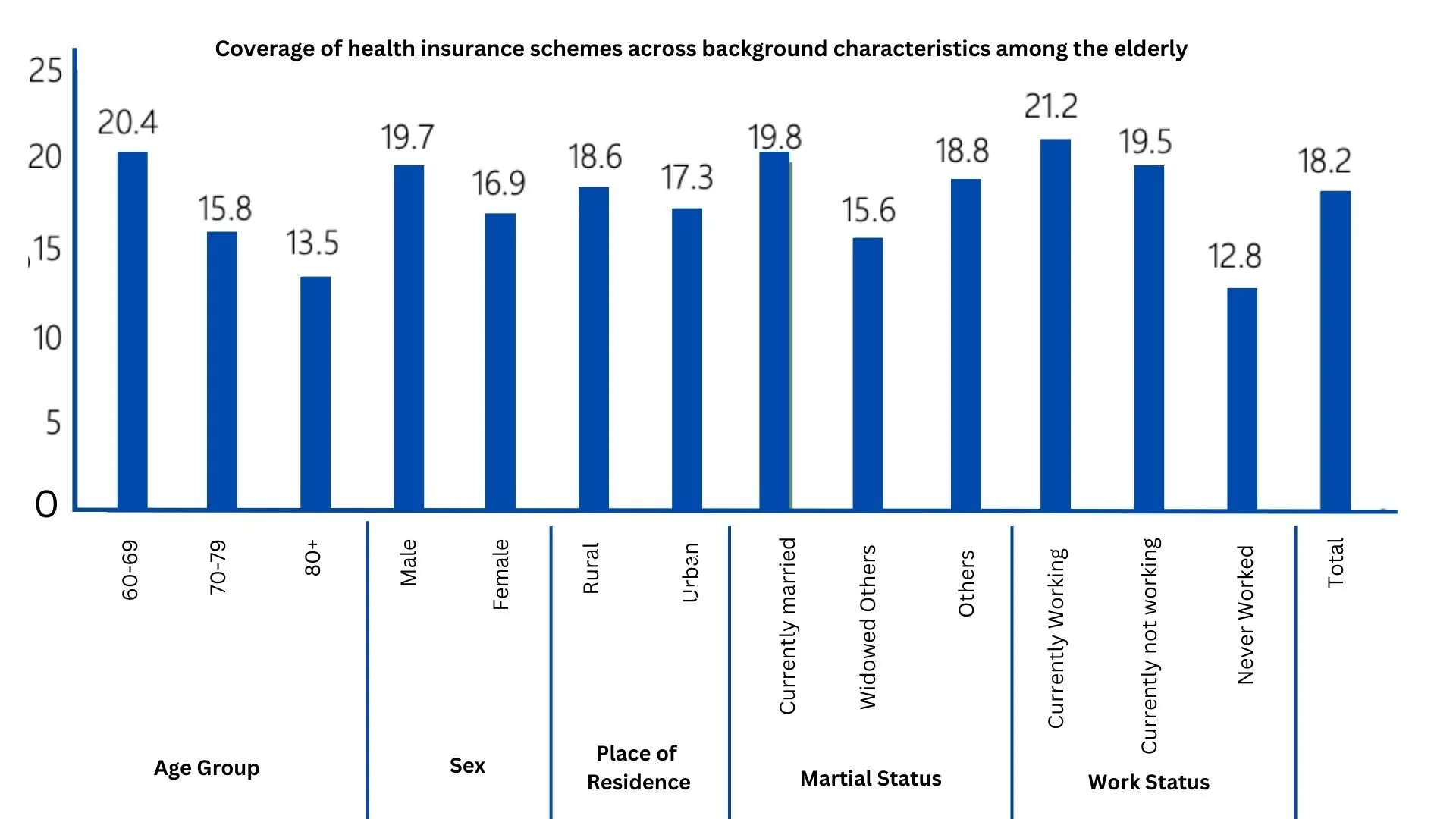

Sarit Kumar Rout, Professor, Indian Institute of Public Health Bhubaneswar, PHFI considers the expansion of Ayushman Bharat a welcome step. “This will address the health care needs of growing elderly population which constitutes 10.4 % of total population now, expected to increase to 19.5% of total population by 2050. According to the LASI study, only 22% senior citizens are covered by pension and 18% by insurance. The universal inclusion of 70+ population in the scheme will alleviate the financial burden,” he opines.

Role of Startups

Startups like Athulya Care are preparing to integrate the benefits of Ayushman Bharat into its offerings for seniors. “We are aligning our services with the scheme’s healthcare packages. This includes diagnostics, chronic disease management, and long-term care. We are also working to simplify the process to access these benefits. Technology will play a key role in this integration, enabling better coordination with government health systems, making it easier to implement the scheme and provide timely care,” explains Srinivasan G, founder of Athulya Senior Care.

He continues: “A key challenge is the limited coverage of long-term care, which is essential for managing chronic conditions. The current scheme is more geared toward acute care. We need greater focus on long-term, palliative, and geriatric care. We would propose extending coverage to include home-based care, assisted living, and rehabilitation. There should be clearer pathways for private eldercare providers to integrate with government systems.”

Another challenge is the reimbursement structure for private facilities. “A more flexible reimbursement model that considers the specialized nature of geriatric care would enable a wider range of services without financial strain,” he explains.