PMJAY Payment Issues: Private Hospitals Call for Urgent Reforms

By Arunima Rajan

Private hospitals call for a 1% interest rate on delayed payments under PMJAY.

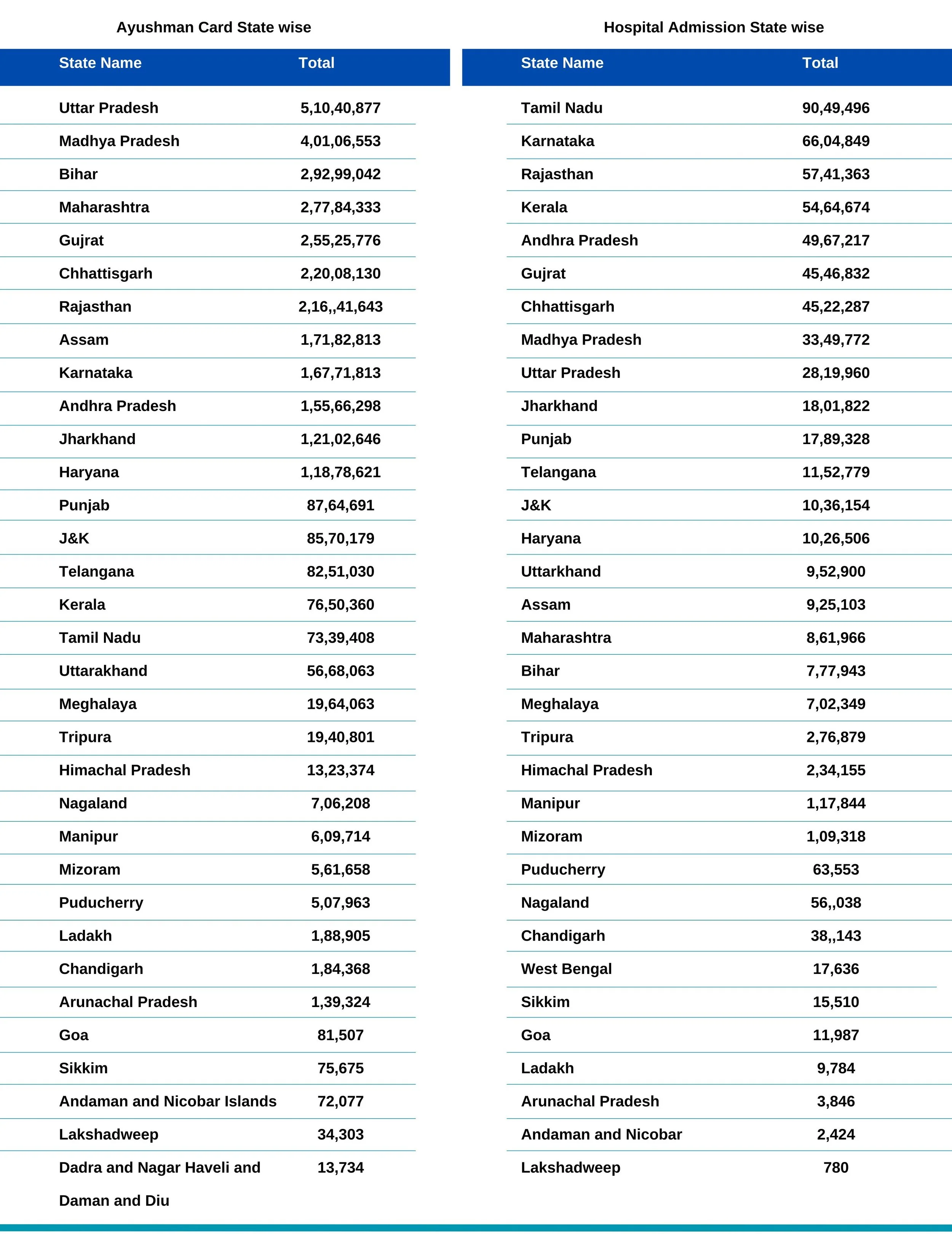

Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (PMJAY), launched in 2018, is India's audacious attempt to overhaul its healthcare landscape. But there's a snag: many private hospitals are avoiding participation due to concerns about slow reimbursements. Hesitancy among private hospitals could seriously dent PMJAY's ambitious goal of providing accessible, quality healthcare to millions of Indians.

Operational Issues

RV Ashokan, President of the Indian Medical Association, points out that the reimbursement rates provided by PMJAY are much lower than the actual costs of the procedures, rendering it financially unfeasible for healthcare providers. Moreover, payment delays are common, worsening the financial burden on hospitals. The grievance redressal system is primarily ineffective, leaving numerous issues unresolved. The mandatory integration into the AB Digital ecosystem adds another layer of complexity without addressing these core issues. Additionally, excluding private hospitals from several procedures further restricts the accessibility and efficiency of healthcare services under this scheme.

Recommendations for Improvement

He further suggests that governments should boost health investment, focusing on public hospitals, infrastructure, and human resources. PMJAY should be used exclusively for strategic purchases from the private sector. The existing master-servant dynamic is ineffective; a collaborative approach is necessary. Scientific costing should be developed through an inclusive and trust-based approach, aligned with quality parameters that meet minimum CEA requirements. Such a strategy is the only practical way forward. Karan Khetwani, formerly with ICICI Lombard, explains that hospitals' financial stability and operational efficiency could be affected to varying degrees (ranging from 0 to 4 on a scale of 10) depending on the volume of delayed claims. Since India largely relies on out-of-pocket (OOP) payments, cash constitutes up to 80% of hospital income. However, this figure varies when analysed by city tier, with higher penetration in Metro and Tier-1 cities. For hospitals with 20-50 beds, the financial impact can rise to 6 out of 10, indicating a state of stress.

The Association of Healthcare Providers of India (AHPI), which includes around 15,000 private hospitals, has called on the government to apply a 1 per cent interest rate on payments delayed for more than a month under the Centre's flagship health insurance scheme.

Financial Challenges

Girdhar Gyani, Director General, Association of Healthcare Providers (AHPI)

Girdhar Gyani, Director General of the Association of Healthcare Providers (AHPI), sheds light on the critical issues surrounding payment delays to private hospitals under the Pradhan Mantri Jan Arogya Yojana (PMJAY) scheme. He discusses the challenges hospitals face, the impact on patient care, and the steps needed to address these concerns. "Beneficiaries under Pradhan Mantri Jan Arogya Yojana (PMJAY) are based on Socio-Economic Cast Census-2011. As per one estimate, many of these beneficiaries have still been unable to be part of the scheme. The process is slow as state governments must reach out to these people. As this number increases, there is financial demand, which unfortunately is not adequate. Therefore, with the current allocation and an increasing number of beneficiaries, reimbursement is bound to be delayed," explains Gyani.

According to Gyani, despite around 28,000 hospitals, including over 12,000 private ones, enrolled under PMJAY, the majority are smaller secondary care facilities. Only about 3,000 of these hospitals have more than 100 beds, and 7,000 have over 50 beds. These smaller hospitals have relatively low financial turnover. As a result, delays in reimbursement significantly disrupt their cash flow, putting their financial stability and sustainability at risk.

Funding Structure

The funding structure of the PMJAY scheme involves a shared cost model between the central and state governments. Typically, the central government covers 60% of the costs while the state governments handle the remaining 40% for most states and Union Territories with legislatures. For the Northeastern states and the three Himalayan states (Jammu and Kashmir, Himachal Pradesh, and Uttarakhand), the central government's contribution rises to 90%, leaving the state governments to cover 10%. In Union Territories without legislatures, the central government may fund up to 100% on a case-by-case basis.

The central government's share can be distributed through two models: the Insurance model, where a flat premium per family is provided to the state government regardless of family size and then passed to the insurer based on the number of eligible families, and the Assurance model, where the central contribution is based on the actual cost of claims or the ceiling amount, whichever is lower.

Gyani explains the issues arising from states like Telangana and Andhra Pradesh merging their health schemes with PMJAY. States can co-brand their existing health insurance or assurance schemes with PMJAY according to the scheme's co-branding guidelines, allowing them to cover more families than those identified by SECC data. However, the states must bear the total cost for these additional families. In the case of Andhra Pradesh and Telangana, the large number of empanelled beneficiaries combined with limited state funds has resulted in significant delays in reimbursements to hospitals.

Private hospitals face operational challenges due to these reimbursement delays under PMJAY. Most of these hospitals are small, and the delays severely impact their cash flow and financial sustainability. This situation leads to two significant consequences: hospitals may start denying patients, and they might cut corners in adhering to standard operating procedures, compromising patient safety and quality of care.

Impact of Reduced Participation of Private Hospitals

The reduced participation of private hospitals significantly impacts patient care, especially during the current heat wave. With more than 85% of tertiary care beds in the private sector, the limited number of around 3,000 empanelled hospitals with more than 100 beds poses a considerable challenge for beneficiaries. Additionally, many of these hospitals are reluctant to admit PMJAY patients because of unviable reimbursement rates and substantial payment delays.

Steps to Address the Concerns

Gyani emphasises the central government's steps to address the private sector's concerns regarding PMJAY. He notes that a process is in place for continuous rate revisions but is progressing slowly. He suggests that the government assign this task to a professional agency like the Institute of Cost Accountants of India instead of PGI Chandigarh. To address reimbursement delays, he recommends implementing a provision for compensating hospitals with notional interest, even at a rate of 1%, to hold state governments accountable.

He highlights that the National Health Authority has introduced a digital platform for processing bills, which, once fully operational, should help streamline payments and resolve related issues. However, he points out that the main bottleneck remains the availability of funds from both central and state governments. Timely release of funds is essential for the sustainability of PMJAY for private hospitals, and it is even more critical than rate revisions. According to him, small hospitals can cope with the current rates as long as they receive reimbursements within the specified timeframe.

Stakeholder perspectives

Anand Garg, former CEO of Seven Hills Healthcare, highlights private hospitals' challenges in participating in PMJAY, including perceptions of inadequate reimbursement rates and inefficiencies causing delays in the digital reimbursement process. He argues that PMJAY rates are competitive for hospitals with low occupancy and those in smaller cities. While hospitals use existing resources for PMJAY services, high-occupancy hospitals may avoid the scheme due to less lucrative rates.

Garg notes that private hospitals play a crucial role in PMJAY, with about 50% of empanelled hospitals and 60% of treatments and reimbursements coming from the private sector. He advocates for a reward and recognition program for private hospitals excelling in quality care and processes, with categories like PMJAY Gold or Diamond. He mentions that states like Madhya Pradesh have already implemented such initiatives.

Feroz Ikbal, Chairperson, Centre for Hospital Management, School of Health Systems Studies, Tata Institute of Social Sciences, Mumbai, points out, "Health is slowly becoming a political issue. This could be why some state governments are not joining PMJAY and have their own scheme. Many states are not participating probably because of political reasons. If you look into these states, we can find that they are ruled by political parties that oppose the party ruling the Centre.”

The Centre can bypass the states and directly provide health insurance. However, even without state participation, the union government can enable citizens to join PMJAY. Most health insurance schemes by state and centre work with the same principle of risk pooling, so there is little significant difference between these schemes. Now, there are multiple schemes across the country. Many of these schemes are in their early phase and are having teething trouble. The major challenge in most of these insurance schemes is the lack of participation from major private players. Many private players are not participating because private players feel that rates fixed are meagre. “Several private players are already not participating in CGHS ( a scheme for central government employees ) because of delays in getting the reimbursement. Also, the government at the Centre and the state can use the scheme to strengthen its infrastructure. The government can also form a coordination committee with representation from the state government to integrate various health insurance programmes,” he concludes.

Government-run schemes have faced issues before. For instance, the Rashtriya Swasthya Bima Yojana (RSBY) encountered similar challenges. A study by the Indian Institute of Public Health revealed that many hospitals declined to admit patients due to administrative concerns, such as delayed payments from RSBY. Gyani warns that there could be significant long-term consequences if these payment issues are not resolved promptly. He underscores that the core objective of any democracy is to provide universal health coverage to its citizens. PMJAY, the world's largest welfare insurance scheme covering 500 million people, relies heavily on timely payments. Payment delays will reduce private sector participation, which provides over 85% of tertiary care beds, rendering the scheme ineffective. This, he warns, would not only have negative political repercussions but also hinder India's progress towards achieving a healthier population and its goal of becoming a developed country by 2047.